A shareholder, as previously defined, has a stake in the company and owns shares. And, historically speaking, EPS has been the standard measurement when comparing stocks and evaluating a company’s profitability. Additionally, both metrics have similar limitations, but there are good reasons why both are standard ways to research and evaluate stocks. Historically, they’ve been reliable methods of comparing companies, determining value, and finding buy or sell opportunities. Additionally, you can evaluate EPS based on how it compares to industry peers and its trends over time.

What Is the Formula for Calculating Earnings per Share (EPS)?

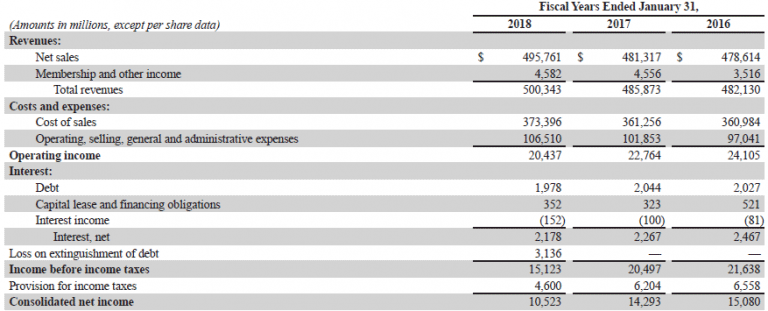

Public companies mostly disclose this number in their income statement immediately below the net income line. The calculation of diluted EPS takes into account the impact of convertible securities and employee stock options that could dilute the company’s earnings per share. So, if a company has securities that could increase the number of shares outstanding, diluted EPS will be lower than basic EPS. EPS is a financial metric used to measure a company’s profitability on a per-share basis. It is calculated by dividing the company’s net income (after taxes and preferred dividends) by the number of outstanding shares of common stock. Earnings per share (EPS) measures the amount of total profit earned per outstanding share of common stock in a specific period, usually either a quarter or a year.

A Variable in the Price/Earning Ratio

It also might cause you to end up with a false price-to-earnings ratio, PEG ratio, and dividend-adjusted PEG ratio. If it loses $10 million with 10 million shares outstanding, basic loss per share is $1.00 even. But the outstanding options — whether in the money or not — do not affect diluted share count.

Formula of basic earnings per share (BEPS)

Earnings per share (EPS) is more or less what it sounds like — a measurement of a publicly traded company’s profits on a per-share basis. We believe everyone should be able to make financial decisions with confidence. As noted in the discussion surrounding anti-dilutive shares, a company can post a net loss, or negative net profit. Again, there are 1 million options outstanding, which would bring in $10 million in cash. The exercise of those options would add 1 million shares to the basic count. In theory, however, ABC could acquire 500,000 shares with the $10 million in proceeds.

- One must check how many shares are outstanding and consider both historical EPS and forward projections in addition to current results.

- Additionally, you can evaluate EPS based on how it compares to industry peers and its trends over time.

- But in the case of mature industries in which low EPS figures are considered the norm, any companies with negative profitability are unlikely to receive favorable valuations.

- Over time a stock price fluctuates with expected future changes in EPS.

- Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

The land on which one of the factories sits has become very valuable as new developments have surrounded it over the past few years. The company’s management team decides to sell the factory and build another one on less valuable land. If you have an how do you report suspected tax fraud activity interest in stock trading or investing, your next step is to choose a broker that works for your investment style. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory.

How to Calculate Earnings Per Share (EPS)

Up to this point, we have not taken into account the impact of preferred stock on EPS computation. Let’s incorporate the dividend on preferred stock in our discussion and see how it impacts the basic EPS formula and computation. However, the expectations set by analysts also play a role in determining the impact of EPS on the stock price. If a company reports solid EPS growth but falls short of analysts’ expectations, it may lead to the stock price remaining stagnant or even declining in the short term. Knowing a company’s EPS can be essential for making an informed investment decision, as a growing EPS usually leads to an increase in the stock’s price.

Likewise, a shrinking EPS figure might nonetheless lead to a price increase if analysts were expecting an even worse result. It is important to always judge EPS in relation to the company’s share price, such as by looking at the company’s P/E or earnings yield. Companies with a complex capital structure must report both basic EPS and diluted EPS to provide a more accurate picture of their earnings.

A higher payout ratio is often a sign that a dividend is unsustainably high, as the company would have to go into debt or cut its dividend in the event of a small downturn in earnings. ABC also has 1 million stock options outstanding with an exercise price of $10, while its stock trades at $20. In that case, the options are excluded because they would increase the diluted share count — and thus actually decrease the loss per share. In that event, the higher diluted share count is making the business look better than it might otherwise be.

Earnings per share detail a company’s progress during one year and is an important benchmark for investors when judging risk. Investors know that without risks, there would be no rewards, but brilliant investors do not take any chance by investing in a company they are unsure about. Nevertheless, it’s important not to limit your fundamental stock research only to EPS, as other metrics should be evaluated as well to generate a well-rounded assessment. On the other hand, EPS is an easy-to-calculate, readily available way to interpret how much profit a company makes per share. While EPS is a widely used and essential tool, it has several limitations and can be easily misinterpreted.

A company that earns $3 per share, and has 1 billion shares outstanding, generates far more profit ($3 billion) than a company that earns $30 per share and has only 1 million shares outstanding ($30 million). Both metrics can be used to understand the fair value of a stock — but from very different perspectives. To oversimplify somewhat, book value per share is a calculation of a company’s assets per outstanding share.

Leave a Reply